Bitcoin is an electronic pseudo-anonymous decentralized crypto-currency. There. That was a mouthful. But what does it actually mean?

Currency: At the most fundamental level, Bitcoins

are just a means of exchange. Just like shells, gold, dollars,

or rubles. And just like silver, euros or stones, their value hinges on an implicit

agreement between the parties using them (legal or informal). Ok. So it's just another

currency. What makes them special then?

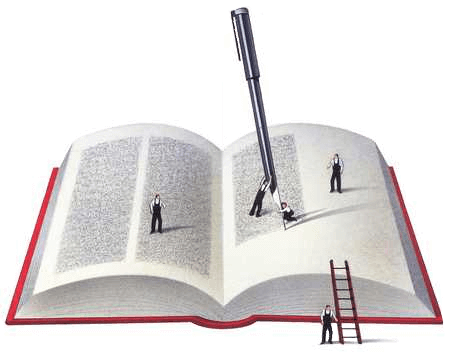

Virtual: Bitcoins are abstract. They exist as anotations on a very big ledger.

On page 33,560 of the book it might say:

- Hal - 3 bitcoins

- Philip - 9 bitcoins

- Wei - 100 bitcoins

- ...

When Wei decides to send Hal 2 bitcoins, it gets updated to:

- Hal - 5 bitcoins

- Philip - 9 bitcoins

- Wei - 98 bitcoins

- ...

I hear you: Who updates the book? Where is the book? and wouldn't it be easy to write a fake balance? Therein lies the beauty of bitcoin: The accountant is not a central authority like the European Central Bank, the FED or the People's bank of China. The book keepers are all those who chose to participate. A good slogan could be:

> Bitcoin, the banking system run by you.

When Moxie sends Runa a bitcoin, bookkeepers ask: Does Moxi actually own a bitcoin? Since the Big Bitcoin Book also contains the history of all transactions it can be checked: Moxie got 3 bitcoins from Jacob who in turn got it from Julian and Julian from John ... all the way back to 2009 when Satoshi sent 10BTC to Hal (here's what a book entry can look like). Ok, so it's verified!! Moxie has the balance in his account according to the whole history of every transaction ever made. We can send Runa her bitcoin, update the ledger and add a transaction to the history.

Distributed: With about 2,500

transactions per hour

and a growing history of 14 x 106

transactions

you can see how the bookkeeping can get complicated: Every accountant on the

planet must check the history, reach a consensus on the new version

of the book and keep their book up to date. This big book is

actually called the "blockchain" and is about 5.7GB in

size today. The computers of the accountants are

constantly calculating the transactions, comparing, and creating

short unique summaries of previous book chapters called

"hashes". For their hard work, bookkeepers (also called

miners) are rewarded. Keeping the system running, safe and

honest has a cost (computers, electricity, knowhow) so for

every

chapter closed 25 bitcoins are awarded to the

bookkeepers proportionally to their efforts. This however, won't last forever.

In 2016 the reward will drop to 12.5BTC and halve every few years until it reaches zero.

Eventually only 21m bitcoins will ever be in circulation and bookkeepers

will be compensated with small transaction fees.

Crypto (secure): The

protocol is too long to explain here, but essentially doing all

these calculations (history checking, consensus, update, summarize)

is so difficult (i.e. needs so much processing power) that Bitcoin

transactions can't be counterfeited. For an attacker to defraud

people by chargeback (making a transfer and then getting the money

back) (s)he would have to buy enough computers to run a network half

as strong as the accountants'. IBM charges

over $100m

per unit of super-computation (peak PetaFLOPS), and the bitcoin

network can deliver 500 of them!

source: stackoverflow

source: stackoverflow

So a wealthy person/state would

need to shell out $25,000 million to trick the network with off the shelf

super-computers! After spending all this money (electricity bill

not included) the attacker can't even counterfeit new money, spend

what (s)he doesn't have or reverse other people's transactions. The

attacker could chargeback and stop the confirmation of other

people's transactions, but not much else. So the only incentive

would be to undermine the trust of the network and devaluate the

currency. The reality is more complex and dynamic: hardware price

drops, cheaper hardware could be used, but the difficulty of

cracking the blockchain also increases exponentially with

time. While Bitcoin was considered a passing fad nobody thought of

stoping it or attacking it. As it grows stronger and complex it

becomes increasingly expensive to halt (It would take 5 full years

of Paypal revenue to buy such an IBM super-computer!)

The highly distributed nature of the bookkeeping and the fact that it

involves a complex problem needing calculations is what makes the Bitcoin Book secure.

source: techcrunch

source: techcrunch

Pseudo-anonymous: In our naive example

above we gave names to each entry on the book, but in reality all

entries are anonymous. Just like your bank account might

be GB70 1200 0300 45 3807628044 a bitcoin account

will be identified by numbers and letters: The ledger will have entries like:

- 1MisPu4HQ68SeRhDzn4y6gEnibn45fsUUo - 5 bitcoins

- 14nghhzmLuqU6UwkvPDYuwnjH2TQKjpDxa - 9 bitcoins

- 1MmadcPb8KYKRgn7RgULUm17rhsExHu6vZ - 98 bitcoins

These addresses are public since all incoming and outgoing

transactions are recorded on the ledger. But if you don't associate an

email address, bank account or picture with the bitcoin address, it's

anonymous. However, consider that paying with it online can leave many

traces (confirmation email, physical address, cookies, IPs). So it's

anonymous in the same sense that browsing online is anonymous

(Anonymous browsing can only be done with the right tools

like TOR, VPN

and the

right precautions).

Why would anyone need anonymous payments? Or conversely: Why should

Visa, Mastercard, Paypal, and many Governments (not just your own)

know what you're purchasing and decide who you can't fund (for

ex. Wikileaks).

Think of an activist buying a forbidden

book, a secure laptop or flight for an undercover journalist, medicine

for that condition insurance companies shouldn't know about. Or

perhaps something which is illegal today: It could be abortion, a gay

magazine, a given medicine, drugs, weapons, alcohol, gambling,

services and a long etcetera depending on the country and period in

history.

Bitcoin's anonymity has its fans and

detractors: When the account is used anonymously it's essentially cash

which can be sent in a second around the world. This can obviously

facilitate money laundering, and illegal activities (like drug and

weapon trafficking). However drugs, terrorism and corrupt politicians

seem to operate fine with regular currencies. So it becomes a

question of principle: Should governments be given unlimited power

over the currency (with risk of hyperinflation, bailouts and

corruption), allowed

to spy on all transactions, and continue

with rampant tax evasion? Bitcoin is obviously not

the solution to these issues, nor will it be a key enabler to crime.

It is just a currency with some interesting features on top: peer-to-peer, security,

public transactions and potential anonymity. But will these features give birth to new currency paradigms?

The Future: Bitcoin is a social and technological

experiment. Its roots are in

the cypher-punk

movement with some libertarian and anarchist influences. Many are

comparing the potential impact of this innovation with the creation

of the Internet. If successful it would question the need

for a money-printing central authority and become a universal currency.

The Bitcoin economy is growing fast. You can pay at

restaurants, buy food, ingredients, electronics, travel,

accommodation, clothes, services, drugs,

porn, blogs, all

major currencies, and

a growing list of

things. However it still remains too technical, and niche for

most. The value of the bitcoins in circulation today (March 2013)

is around $500m, a minuscule amount for any bank or country. This,

however highlights the potential growth for the value of the

currency. If 10m bitcoins end up facilitating half of paypal's

transactions (~$80bn/yr) each bitcoin would be worth ~$6,000. (It's

a very crude estimate, of course, but it gives an order of

magnitude). fortunately there are not only bitcoin cents, but also

mili-bitcoins, down to a satoshi: 0.00000001 bitcoins. So in that

scenario, a bread baguette would simply cost 0.15mBTC (0.15 mili

bitcoins or 150 micro bitcoins).

From a purely practical point of view it's looking more attractive by

the day: You can send anything from $0.10 to $10m anywhere in the

world, almost instantly, for minuscule fees. Try to send 10cents to

a charity of your choice, or try to wire $10m to a third world

country, on a Sunday, in 5 hours. Chargebacks are not possible

(which protects honest sellers from fraudulent buyers). Exchange

fees with other currencies (say Bitcoins to USD) can be as low as

0.5% making currency exchange easy, convenient and cheap.

From the point of view of economics many questions

remain unanswered. If the coins are limited and demand grows it will

lead to deflation. When and how does it stop?

Given the growing mis-trust from central banks, many savers are

hoarding bitcoins. Will that be a problem? How liquid will this market be?

how does a world economy based on bitcoins grow? (degrowth or steady state anyone?)

For a more practical introduction on how to open a wallet, buy or get bitcoins see:

www.weusecoins.com

If you liked the article consider donating to:

14nghhzmLuqU6UwkvPDYuwnjH2TQKjpDxa

14nghhzmLuqU6UwkvPDYuwnjH2TQKjpDxa

The Big Book of Bitcoins,

The Big Book of Bitcoins,